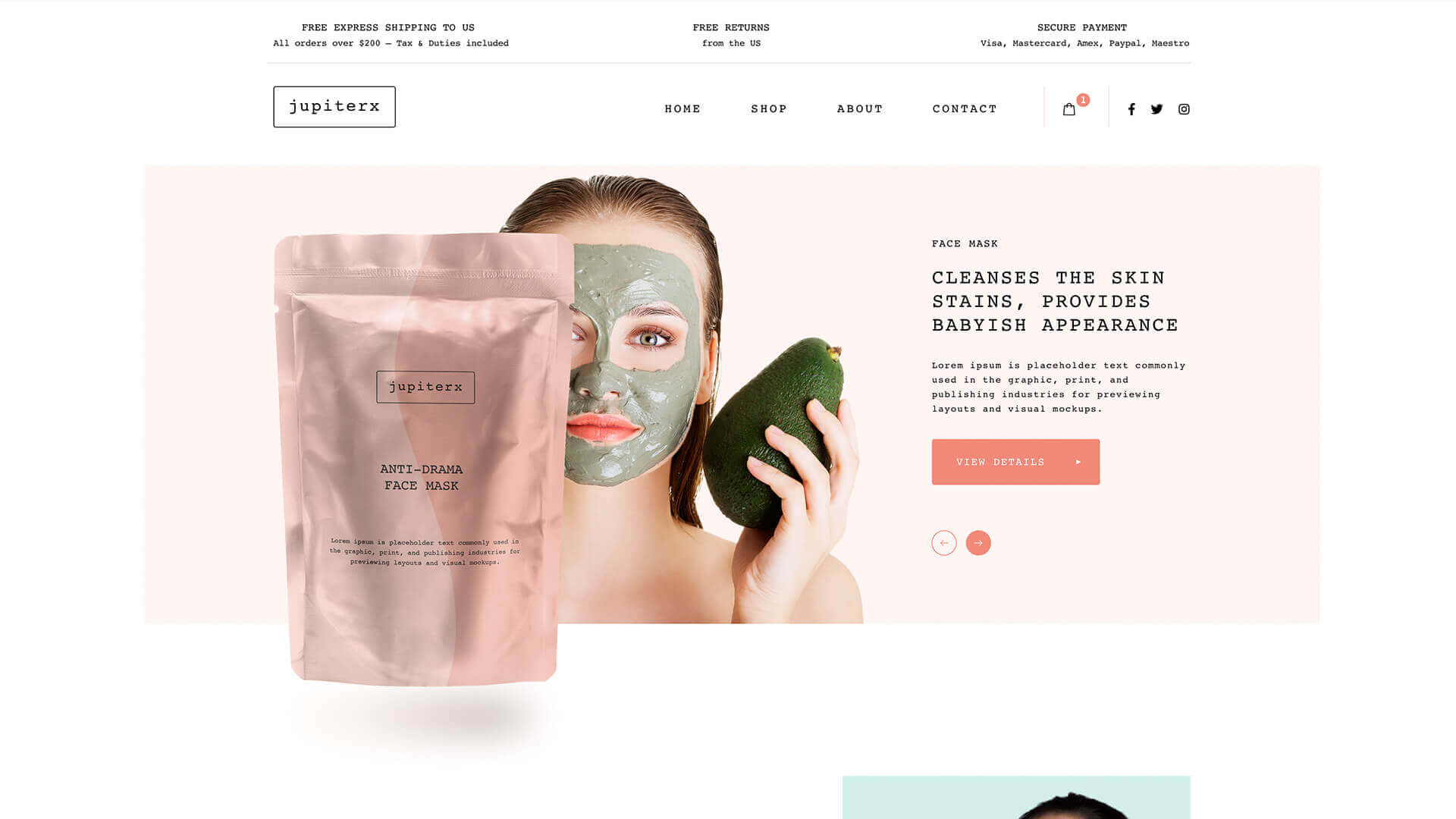

JupiterX Cosmetic Shop Customer JupiterX Cosmetic Shop Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore […]

Continue readingJupiterX Real Estate Company

JupiterX Real State Company Customer JupiterX Real State Company Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse […]

Continue readingIs Crypto Asset Management the Future of Accounting?

While trading has become increasingly popular in recent years thanks to the advent of the internet, crypto trading continues to face multiple challenges that make it unappealing to investors. Many believe it’s as straightforward as buying stocks on Fidelity or ETrade, but there are many differences that set up a number of challenges. These challenges include risk of permanent loss, lack of pricing consistency, lack of security insurance or deposit, and exposure to “pump and dump” schemes, among others.

Crypto Asset Management

Crypto asset management tools are emerging with a clear incentive to capitalize on the cryptocurrency market, which is starting to stabilize. The fragmented environment coupled with the fact that less knowledgeable investors are starting to jump onboard is requiring a platform to deliver easier access. Because of the challenges that have arisen in the market, many are projecting that crypto asset management is the future, with market size anticipated to grow from 94 million in 2018 to 207 million in 2023, a 17.1% compound annual growth rate.

Purchasing cryptocurrencies is still more challenging than other equities, but as cryptocurrencies attract more attention, market participants are requiring straightforward tools to manage cryptocurrency portfolios. The notoriously complex process is proving to be an obstacle for many. With crypto asset management, users can consolidate their diverse holdings, making it easier to manage and to see returns.

Several funds offering crypto asset management that invest on behalf of their customers have already started to emerge, and the model is showing strong results. Bitwise Asset Management, for example, reported a 51% return in less than four months.

Complexity of the Market

Because of the complexity of the market, it will only succeed if new investors have access to resources to simplify the process and enhance their returns–making crypto asset management a lucrative business opportunity. In fact two crypto firms have merged to make crypto asset management easier: CoinVantage and Picks & Shovels. The result of this merger is an eight-person company, Interchange, that will serve an initial 100 clients. Many believe that this merger is representative of what to expect as we march ahead into 2019.

Flexi’s got you covered, even in complex marketplaces

A lot if changing in the accounting space as technology advances and cryptocurrencies stablize and become more commonplace. Fortunately, Flexi helps you handle even the most complex accounting scenarios. Learn more about Flexi today to start preparing for your future. Call 800-353-9492.

JupiterX Construction

JupiterX Construction Customer JupiterX Construction Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat […]

Continue readingJupiterX Construct

JupiterX Construct Customer JupiterX Construct Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat […]

Continue readingWhat Makes a Great White Label Accounting Software Partner?

White label accounting software is an excellent choice for startups and small to midsize businesses. Small business owners report spending, on average, over 80 hours a year on business accounting, and the time spent can quickly spin out of control when dealing with complex accounting issues. Fortunately, outsourcing to a white label accounting software partner is a cost-effective and reliable option for managing your accounting needs.

White label accounting software is software produced by a company and then rebranded and sold by another company. This provides myriad benefits: you can focus your efforts where it counts, which is hugely important in startup and small business environments where staffs are smaller; you can save time, money, and resources; and, you have the best accounting software–the experts in the field–at your fingertips.

- You can focus your efforts where it counts

If you’re working with a skeleton crew, every minute of every day is a precious resource. Being able to outsource complex tasks and processes can be a lifesaver. Instead of reinventing the wheel and developing an in-house accounting solution, take comfort in knowing that you can redirect your efforts to what you and your team are good at.

- You can save time, money, and resources

By enlisting white label accounting software, you can save thousands. While a single accountant’s annual salary can be between $60,000 and $80,000, accounting software can be outsourced starting at just a few hundred a month. And in additional to the salary savings, you also save on overhead, training, hardware, benefits, and more.

- You have experts at your fingertips

White label accounting software provides accounting expertise that a junior accountant who is not yet an expert in their field cannot provide. Having access to the experts gives you peace of mind that your accounting is always up to date and compliant.

How can Flexi help?

Flexi is one of the few vendors that has proven and delivered white label accounting solution integrations at scale for more than two decades. Flexi’s Industry Partnership (FIP) program provides software companies with the ability to OEM Flexi’s accounting solutions and seamlessly integrate them with their products through Service-Oriented Architecture (SOA) and web services.

World leading brands have relied on Flexi’s FIP program to gain a competitive advantage by quickly and easily expanding product offerings, increasing revenue, and providing customers with the convenience of a single-vendor solution, all while avoiding the cost and risk of in-house development.

The following attributes make Flexi a great white label accounting software partner:

- Flexi significantly decreases time-to-market

- Flexi eliminates the risk of stagnant, outdated software

- Flexi strengthens customer loyalty with a more complete solution under your own brand

- Flexi grows revenue through a proven partnership with a trusted leader in accounting software

- Flexi provides expertise and a support team to ensure a smooth implementation

Learn more and explore a partnership with Flexi today. Call 800-353-9492.

Cloud Accounting Statistics You Need to Know

Cloud accounting software is making big waves in the accounting sphere. Cloud software is not only cost-effective and highly accessible, but it’s making data as accessible as ever.

Cloud software can be accessed from any device with an internet connection, at any time of day, by any user. Gone are the days of installing costly hardware that make data vulnerable to hackers, and gone are the days of heavily leaning on IT and infrastructure to get the job done.

With cloud software, many tasks can be automated, which not only saves time but also ensures data integrity and accuracy. And, while many people feel their data is less secure in the cloud than stored locally on their machines, encryption and tight security measures actually make the cloud more secure in many ways.

For these reasons and more, cloud accounting is the future. It’s easy to use, easy to implement and ensures that the reports you need are easy to create, access, and distribute.

Statistics you need to know if you’re considering the switch to cloud accounting software

Don’t take it from us: let the statistics paint the picture. New research shows that 67 percent of accountants prefer cloud accounting over locally installed software options and cloud software reduces labor costs by up to 50 percent. And, the market is growing. The market size is projected to reach $4.25 billion by 2023, from its current $2.62 billion.

Additionally, 58 percent of large companies are utilizing cloud accounting services, and by 2020, it is projected that 78 percent of small businesses will be relying solely on cloud technology. Companies that use cloud accounting exclusively are adding five times the clients than companies who do not, and on top of that, companies that exclusively use cloud accounting also saw a 15 percent revenue growth year over year.

Get on the cloud with Flexi

It’s easy to move to the cloud.

Trusted by enterprises for 25+ years, Flexi is among the most experienced accounting software providers in both the cloud and on-premise markets. Organizations of all sizes, particularly those with complex accounting requirements such as multi-entity and intercompany accounting needs, are benefiting from Flexi’s value: rich features, flexible deployment, easily customized, low maintenance and highly rated support, all at an attractive total cost of ownership.

Learn more about how Flexi can catapult your business today with its cloud-based services. Call 800-353-9492.

How a New Accounting Rule is Getting CFOs Upset

Starting next year, public companies will be required to report operating leases as liabilities. Under this new rule by the Financial Accounting Standard Board, companies will be required to add to their books the debt-like obligations they incur to lease real estate, office equipment, airplanes, and more.

The Wall Street Journal estimates $3.3 trillion in operating liabilities to be worked into the corporate balance sheets of public companies due to this change. While these operating leases are currently resting in the footnotes, they will be front and center in next year’s financial reports.

The change leaves CFOs questioning whether they should renegotiate lease terms, provide specialized reports to lenders, or risk having their debts called by lenders. Legal fees, bank fees, and other fees, fines, and expenses could apply, and the corporate debt-to-earnings ratios will be disrupted, affecting borrowing power.

While the new rule is intended to improve transparency for investors and lenders and bring the U.S. closer to global accounting standards, compliance will result in time and money spent to observe the new rule. This could require new accounting processes or even new accounting software, not to mention the time and expense of staff training. This is undoubtedly a blow to the bottomline for many public companies who are now scrambling to gear up for this regulatory change.

While some CFOs will be seeking to amend loan terms, others may opt to produce one set of financials for regulators and yet another set for lenders. For some, the extra time to produce two different sets of reports is the best available option when the other option could involve hefty bank and legal fees.

As accountants and finance professionals, there is no time better than the present to familiarize yourself with the regulatory change and how it will affect U.S. business to ensure that your books–or your clients’ books–are ready.

The future with Flexi

Flexi knows that compliance is imperative for your business. Flexi provides tools and products to help keep your business up to speed with compliance and regulatory demands. As the accounting rules change, let Flexi help your business succeed.

Trusted by enterprises for 25+ years, Flexi is among the most experienced accounting software providers in both the cloud and on-premise markets. Organizations of all sizes, particularly those with complex accounting requirements such as multi-entity and intercompany accounting needs, are benefiting from Flexi’s value: rich features, flexible deployment, easily customized, low maintenance, and highly rated support, all at an attractive total cost of ownership.

A Government Audit Puts Pentagon in Hot Water Over Serious Non-Compliance Issues

A full financial audit of the Pentagon was conducted and the results showed a failing grade. Auditors requested that various financial irregularities be addressed.

Since the release of the audit results in November 2018, the press has been buzzing about the U.S. military’s assets, which are valued at $2.7 trillion. Over 600 locations were visited to conduct this audit, which involved the work of 1,200 accountants.

Auditors discovered that many back-office functions are not tracked sufficiently, making it very difficult to monitor the flow of cash in and out of the organization. The effort cost more than $400 million, and the Pentagon is being criticized for conducting such a costly audit that would undoubtedly be flawed.

In spite of the results, the amount of financial irregularities and compliance issues discovered during the audit were mostly viewed as unsurprising, and a few agencies did pass the audit: the U.S. Army Corps of Engineers, Civil Works; the Military Retirement Fund; the Defense Health Agency — contract resources management; the Defense Contract Audit Agency; and the Defense Finance and Accounting Service.

Specific instances of fraud were not called out in the report, but the report did specify “significant information technology systems security issues.” The audit also identified 20 “material weaknesses” in the department’s internal controls. The audit further specified that not all transactions are being properly recorded, which makes it very difficult to detect errors in financial statements. Historical cost data is also not being tracked sufficiently.

Rep Adam Smith (D-Wash.) said in a statement that “it is essential that we get the Defense Department to a position where Congress, taxpayers, and DOD itself can track and account for the money that is being used.”

Compliance is important and Flexi knows that

The recent Pentagon audit is a cautionary tale. Don’t let your business receive a failing grade on your next audit. Work with Flexi to ensure your accounting is always in line for your next audit by utilizing accounting compliance software.

Flexible posting and open architecture, with rules-driven engines, enable you to manage your accounting processes in a cost-effective and highly efficient manner. Analyze financial statements and track performance of your lines of business, profit centers, and locations today.

Learn why 20,000 users and counting across dozens of industries rely on Flexi’s accounting software. Contact Flexi today to learn more.

How AI & Automation Are Making Their Way to Accounting

Artificial intelligence (AI) and automation are making their way to accounting, just as they are permeating all other industries. AI is getting stronger and smarter as technology evolves, becoming not just an automator but also a smart technology that can learn and draw conclusions in real time.

As AI continues to advance, many fear it. While the perceived threat of job extinction looms, AI and automation can actually be extremely beneficial for accountants and finance professionals. By remaining adept and relevant in the industry, you are likely not to be replaced by robots anytime in the near future.

Working with AI and automation, not against it

Embracing advances in technology is key to remaining relevant in the industry.

AI and automation largely take the guesswork and possibility of manual error out of everyday processing. A large chunk of accounting tasks were at one time reliant on manual data entry, which meant manual mistakes. Automated, cloud-based software provides a level of security and data integrity previously unknown to accountants. These are all good things.

With increased accuracy and decreased time spent creating and running reports, accountants are left with time left in their day to devote to other, more strategic tasks. In fact an entire component of modern accounting relies on strategic and advisory services, and if your firm or organization has the time to devote to providing such services, you have an immediate edge over your competitors in the field.

While AI and automation reduces or eliminates many of the tasks historically known to the accounting role, AI and automation free up time for accountants to become subject matter experts on the various technologies and systems available today, providing a new level of value to clients.

Additionally, there are many elements in the financial industry that remain impermeable to AI and automation. A study cited by Business.com notes that 68 percent of clients surveyed prefer having access to a financial advisor over a technology offered as a replacement. This statistic makes it very clear that plenty of folks prefer the personal, human element when it comes to strategizing and problem solving. And fortunately, machines can’t replace that.

Flexi helps you embrace the future

Flexi provides software that automates many aspects of the accounting process, freeing up your time and making sure you can close the books and provide reports in a timely manner to boot. Flexi won’t replace you; Flexi will work with you.

Learn more about partnering with Flexi today. Call 800-353-9492.